Prices of flexible packaging materials in Europe steady on high

February 18, 2024Although destocking ends in Q4 2023 demand is stabilising in 2024. The final three

months of 2023 saw a mixed set of results in prices for the basket of flexible packaging

materials used to assess markets across Europe.

While there were gains in the price of HDPE, up 7% on the previous quarter and LDPE, up 8% in the

same period, other results were patchier. The continuing weakness in demand and now the volatile

situation in the Middle East, adding to the Ukraine war uncertainties, have had a negative impact on the

outlook for 2024.

There was a modest decline in the price of 7-micron aluminium foil (4%) . Elsewhere 60gsm one-sided

coated paper fell 7% against the Q3 figures while both BOPP 20-micron film and 12-micron PET film

remained unchanged. A modest rise of 1% for 15-micron BOPA film completes the end of year figures.

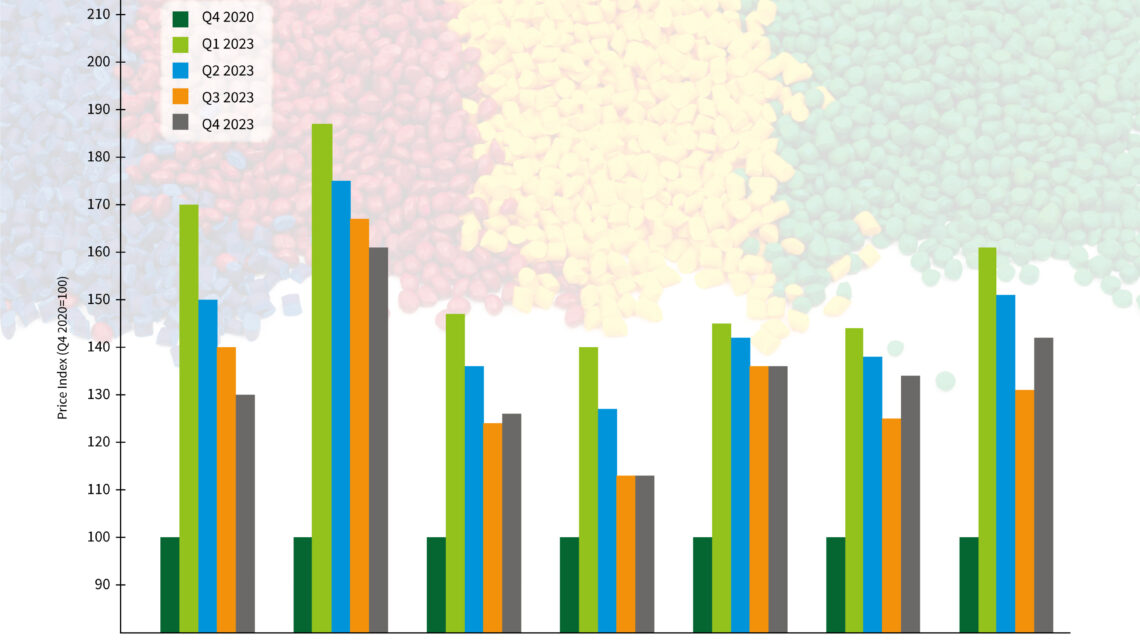

While prices continue to drop or stabilize most are still well above the benchmark price from Q4 2020.

60gsm one sided coated paper, 15-mircon BOPA film, 12-micron PET film, HDPE and LDPE generally

remain between 30-40% above that benchmark, and aluminium foil remains 60% higher. Only 20-micron

BOPP film is returning towards the 2020 measure, at 13% above that price. However, all these prices

are well off the peaks seen in mid-2022.

“Prices paid in Europe for flexible packaging materials were uneven in Q4. They decreased for both

alufoil and one-side coated paper. Alufoil price declines were mainly due to conversion cost reductions.

Paper pricing tended to be stable for small and medium-size customers, while some large buyers agreed

reductions,” according to Santiago Castro, Senior Research Analyst, Films and Flexible Packaging at

Wood Mackenzie.

“For BOPET and BOPP, prices remained stable on average. With demand flat, some attempts by

suppliers to increase prices were rebuffed. BOPA prices rose marginally in Q4, driven mainly by

increases in the price of PA6 resin,” he continued. “As for Q1 2024, consumer demand is expected to

remain subdued. Inventory rebalancing has mostly ended. The situation in the Red Sea is putting

pressure on imported raw materials, which could well drive prices up.”

Adding his views about the latest figures Guido Aufdenkamp, Executive Director of FPE commented,

“The combination of very high stocks along the supply chain and pressure on end-consumer demand

due to high inflation was not favourable for flexible packaging manufacturers and caused a decline of

deliveries in 2023. There is continuous uncertainty due to the various conflicts in and around Europe

and throughout the world bring, but recovery of the European economy, dropping inflation in most

regions and stabilisation of retail sales volumes should have a positive overall influence. The industry is

cautious optimistic for 2024 when comparing the demand of flexible packaging with last year.”