Machine Glazed Kraft Paper Market

March 24, 2021The ongoing innovations in the flexible packaging industry have unlocked several opportunities for various manufacturers to shift from rigid packaging formats. The increasing demand for flexible packaging among various end-use industries has been aiding the expansion of the machine glazed kraft paper market.

Apart from this the demand for aesthetic, durable, and sustainable packaging is enabling a wider adoption of machine glazed kraft paper. Advancement in the technology, higher packaging goals< and wide applicability of the machine glazed kraft paper are expected to drive the market.

In its new study, ESOMAR-certified market research and consulting firm Future Market Insights (FMI) offers insights about key factors driving the demand for machine glazed kraft paper. The report tracks the global sales of machine glazed kraft paper in 20+ high-growth markets, along with analyzing the impact COVID-19 has had on the packaging industry in general, and machine glazed kraft paper in particular.

How the Historical and Future Outlook for Machine Glazed Kraft Paper Market Compare?

The machine glazed kraft paper market was valued at US$ 9.19 Bn in 2020 and is expected to reach at US$ 14.54 Bn by the end of 2030. An increase in the aesthetic and sustainable packaging in various end-use industries across the world, especially in emerging economies is enabling the expansion of machine glazed kraft paper market.

Machine glazed kraft paper usually has a smooth & shiny side and a matt side and is used in the production of small and medium-sized bags. Besides this, it is often turned into envelopes, used in metal working applications, and offer printability. It is used directly in a number of sectors such as food & beverages, personal care, textile, automotive industries, and other.

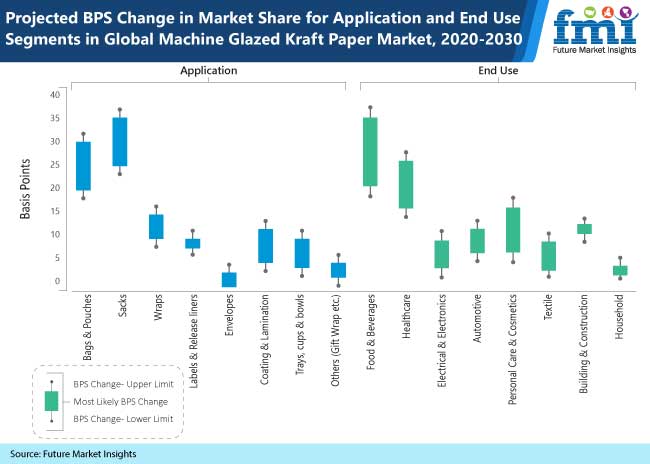

The food & beverages industry is anticipated to register increasing demand through the forecast period. Machine glazed kraft paper manufacturers have attractive growth opportunities as the expenditure on aesthetic packaging and branding by the end-users is rising rapidly. Other end-use industries such as healthcare, personal care & cosmetics, building & construction and textile are likely to create a combined incremental opportunity of US$ 2.77 Bn by 2030.

Further, industrial requirement for different sizes of glossy paper along with barrier properties are resulting in soaring demand for machine glazed kraft paper. An increasing number of buyers across the globe are targeting almost every segment within the paper packaging industry including machine glazed kraft paper. Ability of machine glazed kraft paper to fulfill packaging requirements of both, food and non-food items coupled with pricing affordability and sustainability attracts a significant number of manufacturers in the market.

Soaring Demand from Which Industry is expected to boost the sales of Machine Glazed Kraft Paper?

According to FMI’s analysis, sales of machine glazed kraft paper is increased 1.6 times during 2015 and 2019. The reason behind is the continuous demand of machine glazed kraft paper from the food & beverages industry. Of the various end-use industries that use machine glazed kraft paper, food & beverages industry is a major segment.

Machine glazed paper is predominantly used in the food and beverage industry to manufacture a wide range of packaging application such as wraps, bags, cups, and bowls as it features high level of sanitation and safety with multi-layers of gloss. It also helps in brand promotion as many companies go for advertisement via printing over the machine glazed kraft paper. Consistently increasing production output from the food and beverage sector creates a substantial demand for machine glazed kraft paper for safe and secure packaging of a wide range of food items.

The food & beverages market has registered healthy growth over the decade, which is estimated to continue in the foreseeable years. Also, the take away food culture is bolstering the growth of the global packaged food market. This is likely to create a positive impact on the demand for machine glazed kraft paper across the globe.

Which Grade of Machine Glazed Kraft Paper Is Gaining More Traction?

Unbleached machine glazed kraft paper is a natural kraft paper which is glazed using yankee cylinders and is brown in color. This grade is gaining traction in the machine glazed kraft paper market because it is not treated or bleached by the harmful chemicals such as chlorine. This offers exclusive mechanical strength, printability and flexibility to the machine glazed kraft paper.

Unbleached machine glazed kraft paper can adapt to a wide range of packaging, industrial and processing applications. As per FMI analysis, higher profitability margin is expected with the expanded use of unbleached machine glazed kraft paper, which also is durable and cost efficient. The segment is estimated to expand at a CAGR of 5.0% in next decade.

According to the US Census Bureau, the US imported approximately 367 metric tons of unbleached kraft pulp in 2019. A high demand for eco-friendly and natural packaging formats is pulling the demand for unbleached kraft paper, and henceforth is expected to drive the machine glazed kraft paper market.

What are the Key Trends Impacting Machine Glazed Kraft Paper Sales?

Reusing industrial wood waste by a process of kraft pulping is the latest trend which is followed by the machine glazed kraft paper manufacturers. Kraft pulp made from industrial wood waste can also be used to manufacture machine glazed kraft paper and it may have a darker color than any other pulp.

It is estimated that in Europe approximately 20 to 30 million tons of industrial wood waste is generated per year. Manufacturers of machine glazed kraft paper are reusing this industrial wood waste to manufacture kraft pulp, as it needs less cooking time to achieve the same kappa number as compared to virgin pulp.

Furthermore, industrial wood waste pulp consumes less chlorine dioxide under similar bleaching conditions and is more effectively bleached than loblolly pine pulp. Mechanical characteristics of paper made from industrial wood waste pulp are very similar to that of virgin pulp. Reuse of such industrial wood waste to produce machine glazed kraft paper is gaining considerable traction worldwide, and is helping to achieve sustainable growth as well.

Country-wise Insights

Russian Market Exhibits Maximum Consumption of Machine Glazed Kraft Paper

According to Confederation of European Paper Industries (CEPI), the production of paper and paperboard in the Russian Federation stood at approximately 11,235 Metric Tons in 2019. More than half of the production was imputable to packaging paper. The paper and pulp industry in Russia registers for about a quarter of world production and is a major employer.

The pulp and paper industry is expansion, subsequently creating opportunities for the growth of the machine glazed kraft paper market, especially in Russia. Implementation of stringent regulations aimed at curbing the use of plastic packaging also is expected to boost consumption of sustainable & paper based packaging formats such as machine glazed kraft paper.

Why is Germany Exhibiting Steady Demand for Machine Glazed Paper?

Germany is expected to exhibit increasing demand for machine glazed kraft paper in the near future. The country has been forecast to outshine others because of easy raw material availability and high production capacities. The leading pulp and paper producing European countries are Germany, Finland, and Sweden.

Germany produced approximately 25,746 metric tons of paper and paperboard in 2019. However, amid COVID-19, disruption of supply chain and manufacturing activities has highly impacted the overall market and therefore, a slow-down was also seen in the period of 2019-2020. According to FMI’s analysis, the country is anticipated to account for the leading share in Europe through the forecast period, which is nearly about 28%.

Why are Key Players Investing in China?

More than half of the consumption of paper occurs in China, the U.S. and Japan, with a further quarter in Europe. According to the Environmental Paper Network, China’s average per capita consumption is just higher than the global average at approximately 70 kg in 2019.

China is the world’s largest producer of paper in the world, contributing more than 25% of the world’s paper in 2019. Of the various end-use industries that use machine glazed kraft paper, food & beverage industry is a major segment. According to the China Chain Store & Franchise Association, China’s food and beverage market was valued approximately $590 billion in 2019, with an increase of 7.8% over 2018. Therefore, the key players are investing into the Chinese market.

How is Expansion of Food Sector Encouraging Sales in the U.S.?

According to the U.S Department of Agriculture, with the proliferation of the take away food culture, the food & beverage industry is expected to grow significantly in the U.S. This has propelled the demand for bags & pouches, wraps, and other packaging solutions made of machine glazed kraft paper. Key players therefore have a good opportunity to target the U.S. market.

However, disruptions caused amid pandemic resulting in declining sales in the food and beverages sector also affected growth prospects for the machine glazed paper market. Nonetheless, recovery is underway as economies return to normalcy post lockdown. The same will be applicable in the U.S. market as well, which is expected to account for majority sales in North America.

What are the Upcoming Challenges for Manufacturers in India?

Recently, hike in the prices of all types of paper including the machine glazed kraft paper is seen in India. Manufacturers of machine glazed kraft paper are the worst affected in view of frequent price hikes. Kraft paper is the main raw material, which has already gone up by approximately 70 per cent since January 2020.

The prices of uncoated and coated papers have hiked by approximately US$20 per ton. It is also alleged that the prices would rise further in the near future. Rise in price could negatively affect sales opportunities in India.

Category-wise Insights

Which Machine Glazed Kraft Paper Grade Holds Maximum Market Share?

Unbleached machine glazed kraft paper is estimated to hold a share of 70% in the global market. The segment is forecast to exhibit increase in growth by +240 BPS of current market share during the forecast period. As per FMI, growth outlook for the segment will remain positive because of the sustainable nature of unbleached grade, which has zero green-house gas emission. Unbleached machine glazed kraft paper are non-chlorine treated and ideal for food & beverage packaging.

Why are ‘Above 30 GSM’ Machine Glazed Kraft Paper More Preferred?

The rising demand for flexible and aesthetically appealing packaging is expected to aid sales in the above 30 GSM segment. This category of machine glazed kraft paper is anticipated to account for over 70% of sales registered in the market. End-use industries are inclining more towards above 30 GSM machine glazed kraft paper because of their high mechanical strength as compared to 18 to 30 GSM machine glazed kraft paper.

Which is the Key Application of Machine Glazed Kraft Paper?

Although machine glazed kraft paper is used in various applications, its use in the manufacturing of sustainable bags is expected to rise at an impressive pace. Machine glazed kraft paper is opted more in manufacturing bags & pouches, a trend which is expected to continue through the forecast period. Ongoing advances in spill-proof technology, besides focus on sustainability will continue to fuel demand in the segment.

How is Demand from Food Sector Impacting Growth?

The food and beverages industry is expected to account for nearly one-fourth of machine glazed kraft paper sold among industries. The flexible packaging formats have always been in the play due to several benefits over rigid packaging formats. With excellent mechanical strength and barrier properties, flexible packaging format such as machine glazed kraft paper is considered ideal for industries seeking sustainable and aesthetic packaging solutions.

Besides food and beverages sector, the demand from the healthcare industry will continue driving the market. Steered by the demand from diverse industries, sales of bags and pouches made from machine glazed kraft paper are expected to increase. Several leading manufacturers are focusing on research and development initiatives to cater to demand in a better way. This is expected to bode well for the market.

Download a Comprehensive Report Snapshot

Competitive Landscape

Some of the leading manufacturers have been investing in research and development to gain competitive edge. There is increasing focus towards ensuring fast turn-around, short lead times and production of machine glazed kraft paper in small quantities. Big players such as Mondi Plc., Verso Corporation, Nippon Paper Group and Stora Enso Oyj have been aiming at expanding their existing product lines, which is expected to augur well for the market.

- Mondi Group Plc is manufacturing a latest product line of bags made up of machine glazed kraft paper, which offers an efficient, economical, and easy solution for food packaging, non-food packaging, shopping bags for textiles and a variety of end-use industries.

- A leading producer of flexible packaging and label and converting papers, Verso Corporation has introduced two new series of light-weight machine glazed kraft papers, GlazeWrap NK and GlazeBag NK. These papers are manufactured using unbleached virgin fiber. Verso Corporation also planned to cater to the increasing demand for unbleached fiber papers from consumer brands.

- Charta Global strategically partnered with Asia Pulp & Paper (APP) Sinar Mas, and introduced latest machine glazed kraft paper under the product line ‘Enza Kraft Paper’, which is certified and is made up of bleached virgin pulp. Also, to amplify flexible food packaging portfolio, Asia Pulp & Paper (APP) Sinar Mas introduced ‘New Enza HS Flexpack Unbleached Kraft Paper’ across Latin America and North America in July 2020.