Flexible Plastic Packaging Market – Global Forecast to 2025

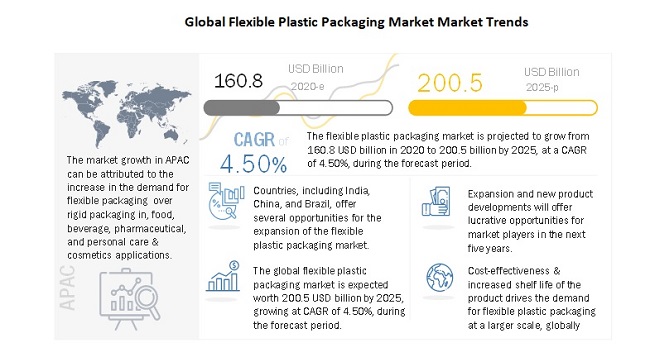

October 22, 2020The global flexible plastic packaging market size is projected to grow from USD 160.8 billion in 2020 to USD 200.5 billion by 2025, at a CAGR of 4.5% from 2020 to 2025. The flexible plastic packaging market is expected to witness significant growth in the future due to its increased demand in end-use industries, such as food, beverage, cosmetic & personal care, and pharmaceutical. Growth in modern retailing, high consumer income, and acceleration in e-commarce activities, especially in the emerging economies, are likely to support the growth of the flexible plastic packaging market during the forecast period.

COVID-19 impact on global flexible plastic packaging market

The global flexible plastic packaging market is expected to witness a moderate decrease in its growth rate in 2020-2021, as the packaging industry witness a significant decline in its production. However, there seems an increase in the demand for flexible plastic packaging for food, beverage, and pharmaceutical applications for product packaging, during COVID-19.

- People are resorting to panic-buying and bulk stocking due to the fear of lockdowns. More people are ordering daily staples and fresh food through online channels, which leads to an increase in the demand for flexible plastic packaging. Governments of many affected countries, for instance, India, have asked the food industry players to ramp up production to avoid supply-side shocks and shortages and maintain uninterrupted supply. FMCG companies are responding by demanding more of flexible plastic packaging products. For example, Britannia Industries has urged the Indian government to ensure interstate movements of suppliers of raw materials and packaging materials.

- The demand for flexible plastic packaging in the pharmaceutical industry, is expected to remain robust as hospitals, drugs, and PPE manufacturers are responding to the crisis. The demand for household essentials, healthcare, and medical goods is not expected to decrease dramatically, and retail distribution for these types of products through online delivery can be expected to increase. This in turn, boosts the demand for flexible plastic packaging solutions for the timely delivery of raw materials and finished goods to their respective end users.

Flexible plastic packaging Market Dynamics

Driver: Cost-effectiveness and Increased product shelf-life

Due to busy lifestyles, the demand for convenient products has increased, thus leading to a rise in demand for flexible packs. Flexible plastic packaging requires fewer resources and energy for packaging; hence, flexible packs are available at low costs and occupy 35% less retail shelf space, rendering them cost-effective as compared to other forms of packaging. Robbie Fantastic Flexibles, a member of the Flexible Packaging Association, states that the manufacturing of 780,000 flexible pouches consumes 87% less coal, 74% less natural gas, and 64% less crude oil in comparison to the manufacturing of rigid clamshell packages. Moreover, there has been a gradual shift in consumer choice from traditional methods of preparing food at home to buying packaged products.

Flexible plastic packaging uses fewer natural resources, requires less energy in manufacturing, and creates fewer greenhouse gas emissions. According to the Natural Resources Defense Council, up to 40% of food in the US was wasted in 2016. Flexible plastic packaging reduces product waste and increases product shelf-life; for instance, bananas packaged in flexible plastic packaging ripen at a slower pace, thus increasing the shelf-life. This type of packaging can be done in the least packaging possible, thereby lowering product warehousing and shipping expenses, while maintaining or improving product protection.

Restraint: Poor Infrastructure facilities for recycling

Recycling of plastic packaging waste is a process that requires state-of-the-art infrastructural facilities. It is a time-consuming process that needs personnel expertise. However, some parts of the world lack these facilities for recycling. Even in developed countries such as the US, the problem of sub-standard infrastructure for recycling persists. Every year, in the US itself, recyclable containers worth more than USD 11 billion are thrown away due to a lack of recycling facilities. According to the UN Environment Programme, the world produces around 330 million tons of plastic waste each year. To date, only 9% of the plastic waste ever generated has been recycled, and only 14% is collected for recycling now.

As most recycling facilities are outdated, they are incapable of handling changes in waste streams. For instance, even though the amount of paper waste has declined, and plastic waste has increased, the existing machinery is ill-equipped to handle such changes in the trends of packaging wast.

Opportunity: Sustainable and new flexible plastic packaging solutions

Dynamic industry changes, such as the introduction of new regulatory initiatives, have encouraged manufacturers to develop new packaging options. Growing concerns regarding the use of bio-degradable plastics for flexible packaging and its impact on the environment have also driven manufacturers to develop sustainable packaging options that are safe and secure. In order to reduce the cost pressure and maintain the integrity of product packages, manufacturers are considering sustainable packaging solutions that require fewer materials and energy to manufacture a package, reduce transportation expenses, and offer extended shelf-life to the product.

Due to stringent government regulations, changing consumer preferences, and environmental pressures, manufacturers are steering their strategies toward circularity and leveraged new plastic technologies to develop recyclable and sustainable solutions that include specific properties such as oxygen, moisture, light, puncture, and chemical resistance, and easy-tear propagation. While, key focus areas for manufacturers include the development of alternative bioplastics solutions such as polybutylene succinate and biopolyproplyene, along with the price and disposal of bioplastics, which will need to be examined to ensure successful usage.

Governments all over the world are encouraging the use of sustainable packaging in order to minimize waste. In 2018, the UK strode forward to become the world leader in sustainable packaging. With an investment of USD 80 million (£60 million), the government called on innovators to develop packaging, which will reduce the impact that the harmful plastics are having on the environment. The Packaging and Packaging Waste Directive has been established in Europe, which has two main objectives: to help prevent obstacles to trade and reduce the impact of packaging waste on the environment. According to this directive, the EU States shall ensure that the recovery and recycling of packaging are made effectively and that the use of hazardous constituents in packaging is kept to a minimal level.

Challenge: Recycling & environmental concerns associated with flexible plastic packaging

According to the World Economic Forum, every year, at least 8 million tons of plastic leaks into the ocean, which is equivalent to dumping the contents of one garbage truck into the ocean every minute. This is expected to increase to two per minute by 2030 and four per minute by 2050, which can destroy the ecosystem. About 90% of all the trash in the oceans is from plastic. Estimates suggest that flexible plastic packaging represents the major share. Hence, recycling becomes a major challenge in the flexible plastic packaging industry, which provides re-use value, and results in lower wastage.

Pouches widely preferred for flexible plastic packaging

Based on type, the pouches segment is projected to be the largest market for flexible plastic packaging. The dominant market position of the segment can be attributed to the increase in the demand for these type across various applications in food, beverage, pharmaceutical, and personalcare & cosmetic industries. The increase in the demand for pouches can be attributed to the rise in the demand for lightweight and convenient packaging solutions.

Significant increase in the food products during COVID-19 pandemic

By application, the food segment is projected to be the largest segment in the flexible plastic packaging market. People are resorting to panic-buying and bulk stocking due to the fear of lockdowns. More people are ordering daily staples, FMCG, and fresh food through e-commerce & online channels, which leads to an increase in the demand for flexible plastic packaging solutions. This in turn, boost the demand for flexible plastic packaging market for food application.

APAC region to lead the global flexible plastic packaging market by 2025

The APAC region accounted for the largest market share in 2019. Factors such as improving global economy, expanding working population, rising domestic demand for ready-to-eat & convinence food products are expected to boost the market for flexible plastic packaging. The market for flexible plastic packaging in APAC is growing in the food, beverage, pharmaceutical, and personal care & cosmetics industries due to the functional properties offered by flexible plastic packaging, such as safety, cost-effectiveness, durability, strength, lightweight, environmental-friendliness, and handeling convenience.