Bioplastics to grow to around USD 4.4 billion by 2026

February 5, 2020Polylactic acids, starch blends, cellulose, and other bioplastics achieve significantly higher growth rates than conventional standard plastics. With this study, Ceresana has examined the world market for “green” polymers for the fifth time already. Bioplastics can be used in a growing number of application areas. Their future development is predicted to remain dynamic: this latest Ceresana report expects revenues generated with bioplastics to grow to around USD 4.4 billion by 2026.

Different types of “bio”

This study deals with two groups of materials that are called bioplastics, although they are not necessarily identical:

- Biodegradable plastics can be composted,

- Bio-based plastics are produced from renewable resources.

Fiber-reinforced plastics on a fossil basis, elastomers, duroplastics, and wood-plastic composites (WPC) are not covered by this study.

Biodegradable plastics, such as polylactic acids (PLA) and polymers on the basis of starch, reached a market share of 56% of the total market for bioplastics in 2018. Ceresana predicts further growth in volume of 7.1% per year up until 2026 for this product group. Growth regarding bio-based plastics, such as polyethylene, PET, or PA which are not biodegradable, is expected to be weaker with 5.1% per year.

Packaging is the main application

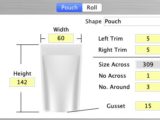

This study analyzes the development of bioplastic usage in various sales markets. Demand is subdivided into the categories rigid packaging, flexible packaging (bags and sacks), other flexible packaging, consumer goods, automotive and electronics, and other applications. The most important sector for sales of bioplastics in 2018 was the packaging industry – more than 60% of bioplastics were processed in this sector. However, Ceresana expects the highest percentage increase in the future for the category automotive and electronics with 8.4% per year.

Manufacturers and processors of bioplastics are facing great challenges:

- Bioplastics need to be able to compete in terms of price with their fossil counterparts. Alternatively, they must offer added value in order to justify the price difference.

- The availability of bioplastics in high quality, their reliability, and volume must be guaranteed.

- Recycling/composting: bio-based plastics can be recycled as long as they have the same chemical structure as their fossil counterparts. However, this is primarily the case for bio-based products, such as bio-PE and bio-PET. Biodegradable plastics that do not have the same chemical structure are more difficult to handle. The respective recycling and composting infrastructure plays a crucial role here: problems arise when plants are not designed to separate bioplastics or when they are unable to biodegrade them.

- Sustainability: in order to form a positive assessment, it has to be clear how and whether a type of bioplastic offers advantages in comparison to other materials in terms of production (use of resources), use (longevity), and disposal (recycling/processing). It is then also decisive for image and market success whether these advantages are recognized and rewarded by consumers.